The Future of the Art Market: Blockchain

Part 1

Authenticating art in the digital age is proving increasingly difficult. Though the art market has faced issues of counterfeiting and fraud for years, might advancements in technology provide the solution? Could blockchain technology and smart contracts be the art market’s future?

What is blockchain technology?

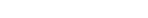

Blockchain is an electronic, transparent, public and distributed type of ledger. Though it has been used within the financial industry for years, it has seen a slow adoption rate in the art world. The art market is not known for its willingness to change, so this should not come as a surprise.

Since blockchain technologies are commonly associated with cryptocurrencies, how would they benefit the art industry?

Blockchain is a consensus algorithm. It allows people from around the world to perform secure transactions, whilst circumnavigating third parties. When a transaction occurs on a blockchain, instead of being recorded on an individual, centralised ledger, it would appear online – accessible through a specific “key”. When accessed, an immutable trail is left behind.

The security of the platform ensures an object’s data is verifiable to law enforcement and associated parties, whilst keeping the identity of the individual confidential. The immutability of the technology is paramount to the consensus that exists between the invested parties.

Image courtesy PWC.

How will this affect the art world?

Blockchain technologies would be transformative to the art world. Artworks could be assigned a digital, scannable signature, archiving its provenance and tracking its whereabouts on a decentralised system. A digital trail, which is almost impossible to change, would follow an artwork’s lineage. This would allow anyone with access to the blockchain an opportunity to confidently assess its historic and economic value.

The benefit of smart contracts

A smart contract is a computer protocol intended to electronically facilitate the negotiation of a contract. Purchasing art with a smart contract may solve transparency issues and help artists get paid fairly and consistently. Smart contracts, which would function through a blockchain, allow trackable and irreversible transactions to occur.

Smart contracts release funds simultaneously and in doing so they remove the burden of trust between cooperating parties. This is significant. It means two parties do not need to trust each other for a transaction to be safe. They only need to trust the operating mechanism that enables the consensus to exist. For artists, this means more transparency and it might enable them to (automatically) profit from any future resale of their work.

The art world’s lack of transparency is not without consequence. Validating an artwork’s provenance is both time-consuming and resource-draining. It can cause mistrust to grow between the artist and their patron and it can dissuade potential collectors from investing in art.

According to the Hiscox Online Art Trade Report 2018, while existing art collectors are familiar with a lack of price transparency when purchasing art, for 90% of new art buyers, it is a significant issue that isn’t being addressed. The use of blockchain would go a long way to alleviating these issues.

When will we see widespread adoption of blockchain technologies?

Start-ups have made the first inroads with new technologies. Blockchain, however, is unlikely to succeed on a wider scale without the endorsement of major institutions, auction houses and galleries. Large galleries and auction houses account for the vast majority of high-value transactions within the industry. If blockchain can directly affect their monopolisation, what is the likelihood they will adopt the system?

The Hiscox Online Art Trade Report 2018 states its high expectations for the incorporation of blockchain, though it reports minimal adoption thus far. 60% of online platforms believe that the use of cryptocurrencies will be the way blockchain technology makes its debut in the online art market. However, only 7% presently accept cryptocurrencies as payment and just under 10% have embedded blockchain technology into their businesses. Furthermore, 64% of online platforms believe that using blockchain as a “title/ownership registry for the art and collectibles market” will be the “most successful use of blockchain technology in the future.”

The 2018 TEFAF Art Market report suggests 75% of auction houses, 30% of intermediaries and 20% of galleries plan to offer blockchain technology within the next five years. If this report is accurate, this would be transformative to an industry that has remained largely unchanged for decades.

Simon Denny, Blockchain Future States, Installation view 18, 2016. Image courtesy artist.

The companies pioneering blockchain tech

Verisart is one of many companies certifying artworks and collectibles using the Bitcoin blockchain. They claim to be fighting art forgery by providing an ‘airtight’ authentication methodology that allows for real-time verification of artworks using image-recognition technology. Their initial target is to authenticate works for living artists. In the long run, they plan to retroactively authenticate older works by working with artists’ estates.

Artlery, another business using blockchain technology, offers software that functions through an app. It allows artists to track engagement with their artwork no matter where the artwork has been physically exhibited.

Blockchain tech may create an infinitely more secure platform for transactions and access to information than what currently exists. An openly distributed title registry could set new standards for privacy and transparency, and, in the form of digital certificates, increase trust and liquidity.

In The Future of the Art Market: Part 2, we explore the hardware that enables artworks to be registered upon a blockchain.

Author: George Greenhill